The Modern Core Platform

for P&C Insurers

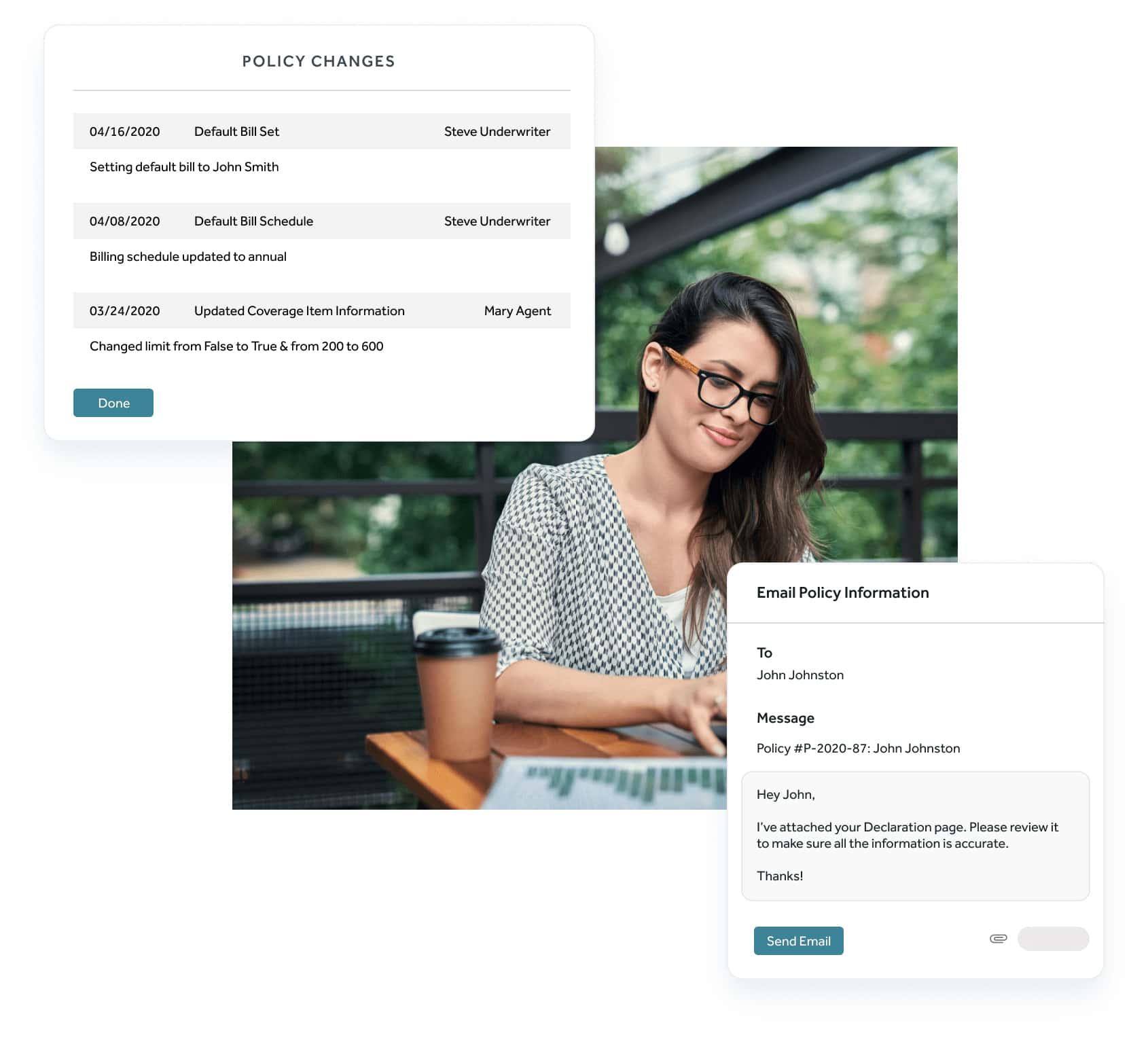

BriteCore is a cloud-native platform for P&C insurers that unlocks business growth, delivers greater productivity and efficiency, and provides a modern customer experience.

Discover Data-Driven Business Insights

BriteCore Reporting & Analytics includes persona-based executive dashboards, advanced analytics, and reporting. Executives, line-of-business leaders (underwriting, claims, billing), and agents can immediately access pre-configured dashboards, tap a library of standard reports, and create custom views and reports to identify and act on new business opportunities for growth or cost savings. Built for configurability and rapid, real-time execution, BriteCore leverages modern in-memory database, machine learning, and data visualization technologies.

Engage your agents and policyholders with a modern experience

Operate your business with an all-in-one cloud-based solution

Manage your daily P&C operations from a single, web-based insurance platform.

- All core, portal, reporting and analytics components offer a cohesive and consistent experience optimized for your users.

- Built on the world’s leading cloud platform, Amazon Web Services (AWS), insurance carriers and MGAs can grow with confidence, knowing your core platform is always available.

- As a cloud-based solution, minimize business disruptions — local, regional, or national — by giving your team the ability to work remotely and unconstrained to a physical office.

Hit the ground running with flexible tools and templates

Product and Document Templates

Reuse your existing product definitions and documents as templates for rapid expansion into new markets.

Automated Cloud Deployments

Quickly spin up — and just as quickly spin down— new pilot programs and greenfield initiatives using our automated scripts.

Tap into new capabilities with our APIs and 3rd party solutions

We designed our software to be connected so it can evolve and incorporate the latest insurance industry trends and technologies over time. The BriteCore ecosystem delivers a wealth of new capabilities through our partnerships with a wide range of third-party insurance solution providers. In addition, our built-in APIs enable BriteCore and our community to quickly build new value-added integrations.

Choose your own flexible path to continuous innovation

Our clients benefit from continuous updates to our software that keep pace with changes in the insurance industry and the latest insurance technology. The ongoing evolution of the BriteCore platform helps ensure your team is fully equipped to meet the challenges of today and tomorrow.

Cloud-native architecture

AWS ecosystem

Continuous update process